Here are three tactics to influence your hotel’s net operating income and make your boss happy! Expense Reduction's Impact on NOI And those with negative numbers? That would be Net Operating Loss, or NOL. Since NOI is a fundamental metric for calculating a hotel's ability to generate profit, it correlates directly to hotel valuation - and thus a focus for owners and management: Hotels with healthy/growing NOI will be valued more highly than those with low/diminishing NOI. Understanding NOI informs our investment decisions and are more important now than ever before. Ultimately we use a lot of terms and acronyms in real estate investing but ultimately we want to know how we're doing relative to comparable properties.

#Noi calculation example how to

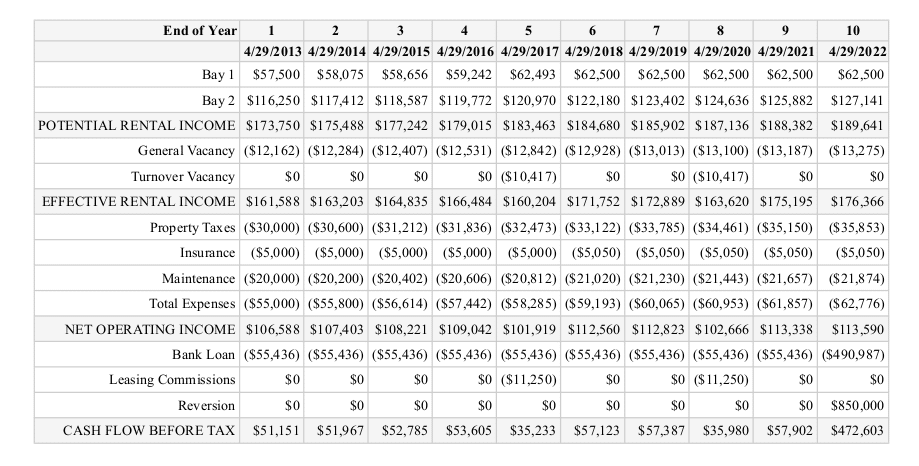

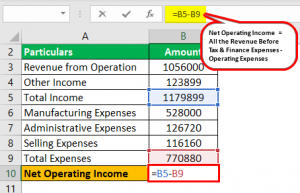

Whether you own a hotel, rental property or own any other kind of commercial property, understanding the net operating income formula (and how to grow NOI) is critical to your success. EBIT is equal to NOI + interest expense + taxes. It's not only real estate investors care about NOI - lenders typically base their willingness to lend on the amount of earnings before interest (EBIT) that a property can generate. See why NOI is so important to hotel owners?īut wait, there's more. That hotel's value would likely hover around 1,000,000/.06 or $16.7M. Let's say a hotel does $1M in NOI and it's located in downtown San Francisco with a cap rate of 6%. We'll get deeper into cap rate in a future article but the value of a hotel can generally be measured by dividing NOI by cap rate. Why is NOI so Important to Commercial Real Estate Owners?Įvery facet of real estate investment is based around NOI since investment properties are valued and compared by a metric called capitalization rate (cap rate). Other factors that influence NOI include a property’s ADR, the market segment it serves and the property’s characteristics, such as age, amenities and location - all things that affect a property’s income potential and overall cost structure. Ideally, you'd like to do both! If you successfully increase income and reduce expenses, you'll see a much more powerful impact on NOI than doing one over the other. Given the relationships in the formula, you can increase net operating income in two ways: increase revenue or reduce expenses. Not included here are any expenses related to debt payments, income taxes, capital expenditures, depreciation and amortization. Among these expenses are insurance, brand fees, property management fees, utilities, property taxes, repair cost and maintenance (even preventive maintenance), payroll, commissions and anything else related to day-to-day operations. Operating costs are all expenses necessary to maintain and operate the business. Gross income would include all potential rental income a property generates, from both rooms and non-room lines of business. In that case, the formula is: NOI = (Gross Income - Operating Expenses/Gross Income)*100. NOI can also be expressed as a percentage of total revenue, which is how hotel management can easily identify upward and downward trends in profitability. Property owners focus on this metric because it tells them a lot about property value, potential rate of return on investment and even impacts financing costs like mortgage payments since banks and lenders want to know that there's enough income to cover interest payments. NOI = Gross Operating Income - Operating Expenses and can be found at the very bottom of your income statement. Understanding the NOI Formula (NOI Calculations) You may also see this metric as net operating profit, or NOP. NOI is less prone to manipulation than other metrics, as you can’t really perform too many tricks to inflate income or reduce expenses. It's a profitability metric that shows you how well a hotel operates, from both a total revenue standpoint and total expenses standpoint. NOI, which stands for net operating income, is the amount of money left after you have paid out all of your expenses. In this article, you’ll see the value of NOI by learning both how to calculate it and how to translate it into operational improvements at your hotel.

From RevPAR to ADR, tracking key metrics are what allows us to understand our performance, improve operations and ultimately drive profitability for management and owners.īut what's the point of working so hard operating a hotel if you are not making money once all expenses are paid? Cash flow is king! That’s where net operating income comes in: it shows you how well you’re doing at managing expenses and turning top-line revenue into bottom-line profit.

We love metrics in hospitality and real estate.

0 kommentar(er)

0 kommentar(er)